TRANSCRIPT

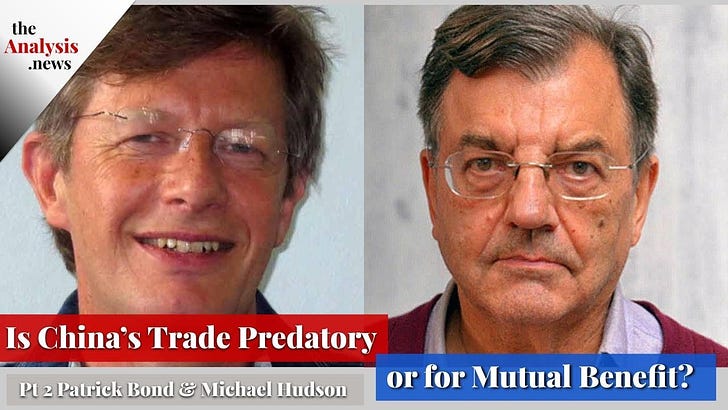

Paul Jay

Hi and welcome back to theAnalysis.news, I’m Paul Jay. We’re going to continue our conversation with Patrick Bond and Michael Hudson about China. The first part, if you haven’t watched it, you probably should go back and watch it because it’s about more of the domestic situation. Now we’re going to talk about China’s international footprint and how we see it. So join us back in just a few seconds. Please don’t forget the donate button, subscribe button, ring the bell button if you’re watching on YouTube, and most important thing, get onto our email list by going to the website.

So this is the second part of my discussion with Patrick and Michael. We’re going to talk now about China’s international footprint. We ended the last segment by talking about Michael’s comment in terms of climate change. China at least has the ability, or more capability, of dealing with climate rather than the United States, particularly with a government so dominated by fossil fuel interest. It was left with the jury is still out on whether China will or will not, and that’s a whole other conversation, which we’ll do in another segment. We’ll really dig into just what is China doing when it comes to climate change. Now we’re going to deal with two questions. One is the sort of neocon accusation, but it’s also coming from the [Joe] Biden administration. Although the Biden administration has a lot of neocons these days, which accuses China of being aggressive in a military way, they point to the South China Sea and Taiwan and such.

The second issue is China and its economic relations with other countries, trade for mutual benefit, investment for mutual benefit, as China claims? Or is it a form of predatory capitalism? And that’s really where we’re going to spend most of our time talking about today. When it comes to Taiwan, we’re not going to talk much about Taiwan or at all because, one, it’s not an external issue. Taiwan is part of China. Whatever you make of China’s policy towards Taiwan, it is part of China, and it’s really quite a separate question.

So we’re going to start with the question of China’s economic relations with other countries. As far as being in an aggressive military country, as I said, the Americans are claiming. I don’t even see the point of talking about it because I don’t know where it is. So if somebody can write in and tell me where China is militarily aggressive, please do. I don’t know if any of my guests want to say that, but right now, I don’t even know what one would talk about. So we’re going to dig into it, as I said. Is China’s investment economic relations, trade and investment loans for mutual benefit? Or are they predatory?

And so now joining me again is Patrick Bond. He’s a political economist and political ecologist. He teaches at the University of Johannesburg at the Department of Sociology. Also joining me is Michael Hudson. Michael is an economist Professor Emeritus of Economics at the University of Missouri Kansas City, a researcher at the Levy Economics Institute of Bard College. He’s also a former Wall Street analyst. Thank you both for joining me.

Patrick Bond

It’s great to be back. Thanks, Paul.

Paul Jay

All right, so Michael kicked us off in the first segment. So, Patrick, you kick us off. So trade for mutual benefit or predatory? What do you say, Patrick?

Patrick Bond

Well, predatory because China is absolutely joining within global capitalism. I mean, don’t take it from me. May I quote Xi Jinping himself, World Economic Forum, a couple of days before Donald Trump was inaugurated as President in 2017, he said, quote; in the DaVos World Economic Forum, the big gathering of capitalists. “We must remain committed to developing global free trade and investment, promote trade and liberalization. We will expand market access for foreign investors, build high standard pilot-free trade zones, strengthen protection of property rights and level the playing field. China will keep its door wide open and not close it. Any attempt to cut off the flow of capital, technologies, products, industries and people between economies and channel the waters in the ocean back into isolated lakes and creeks is simply not possible.”

Within a few months of saying that, Paul and Michael, Xi actually showed you could, and he put on all sorts of trade restrictions and financial restrictions and banned cryptocurrency. So I have no doubt that if there’s political will in China, there are the instruments to actually change the system. The choice of the Chinese capitalist class and Xi Jinping as its leader is to basically amplify global neoliberal corporate rule. I’ll start with that provocation.

Paul Jay

Well, go ahead and give us some examples before we go to Michael.

Patrick Bond

Now the main reason that China would want to do this is because it’s overproduced. It has vast excess capacities in its industrial and productive sectors. It’s in that Paul and Michael, I think you have to agree. We in the continent of Africa and here in Johannesburg, the world’s most unequal city, benefiting from the historic repression. What we’re even seeing in South Africa is the predatory capacity of Chinese financial capital that is promoting trade and new foreign direct investment. That is, let me say, intersub-Imperial.

So there are really two features to what we’d be worried about. One is that when China does export, it exports all around. What we’re finding certainly is the most serious sites of corruption in rail, corruption for locomotives built in China, financed by the Chinese banks that are going to carry coal. Those were done with the family called the Gupta’s, and they’ve had to be cancelled. I mean, there are more than 1000 locomotives to carry coal that were ordered. A second case would be the extent to which the largest industrial project in the country is going to be driven by China based on a coal-fired power plant and heavy industry, which will be highly carbon-emitting.

A third case here is a knockdown kit-based factory for cars. So instead of really integrating into a well-developed automobile sector, China brings sort of readymade, very capital intensive systems. I could go on, and South Africa is one of the stronger sites, but you could go to Zimbabwe, where that export of capital has entailed brutal repression for the sake of gathering cheap diamonds. So on the East side of Zimbabwe, the biggest diamond fields in the world, Morangi, the Chinese are very much in on that and very repressive, working with the Zimbabwean dictatorship, actually being involved in the coup against Robert Mugabe in 2017 to ensure that conditions were even better for Chinese extraction.

We could go through any number of the countries in this region in this continent to show a kind of new scramble for Africa. Excess capital in China, looking for a route out, finding Africa quite easy pickings and indebted many African countries. There is a Western rhetoric, which is the debt trap diplomacy kind of nonsense as if the West doesn’t do the same. On the ground, it’s absolutely brutal to be a victim of Chinese corruption, ecological damage, and then this overcapacity displaced into Africa.

These would be some of the examples I could go into the next stage, which is the multilateral relationships that Xi was talking about in DaVos, in which in the UN [United Nations], UNFCCC [United Nations Framework Convention on Climate Change], the World Trade Organization, the IMF [International Monetary Fund], the World Bank and countless other venues of Imperial power, multilateral globalism by imperialists and sub-imperialist powers working together. China’s setup as a set of global rules, it just doesn’t work for the rest of the world.

Paul Jay

Before I go to Michael and you can expand on this if you want, Michael. I want to say something I said in the first segment what Patrick is saying, although he might disagree with me. I don’t think so. Nothing China is doing compares to what the United States and the West does.

Patrick Bond

I’ll agree with you and say that the Western colonial powers, the European powers, came in and totally looted and wrecked Africa and divided it up. Then the United States in the post-war era. The Western model is something that China hasn’t broken with but has amplified. That’s the whole point. This is, let me call it, sub-imperialism because it fits within imperialism. Sometimes it’s inter-imperial rivalry at stake like the Cold War, Soviet Union, and the U.S. We’ll see Africa becoming a site where competition for those raw materials for fossil fuels will continue between the West and China. The overarching approach is exactly what Xi Jinping told the World Economic Forum. Quote, “We must remain committed to developing global free trade and investment and promote liberalization.” And that’s a very dangerous thing for a weak continent like Africa.

Paul Jay

Okay, Michael, go ahead.

Michael Hudson

Well, I have not followed Chinese foreign investment at all, so I literally have no knowledge or familiarity with that. What I can talk about is what I’m a specialty in, and that is super imperialism. It’s how the United States has used the International Monetary Fund and the World Bank and international diplomacy to create a dollar standard that has underdeveloped the Third World and has been a disaster ever since Bretton Woods came into being in 1944.

The strategy of the World Bank is to make export loans from Southern sphere countries in ways that do not compete with the United States. The absolute prime directive of the World Bank is you must make other countries depend on their food, on the United States, you cannot have countries grow their own food. What I was told at the Chase Manhattan Bank was wherever there is land reform, there’s communists. The U.S. policy has been to overthrow any government at all that is seeking land reform or seeking to grow its own food supply.

The IMF has worked hand in hand with the World Bank to essentially back oligarchies, especially financial oligarchies friendly to the United States, to make loans basically for capital flight by foreign investors headed by U.S. companies and by domestic client oligarchies, to move their funds out of the country at subsidized rates of IMF loans, then devalue. The IMF philosophy is the way that Third world countries can compete is to lower their living standards, to keep lowering the price of labour, to keep sucking up income to the top by foreign investors and the local oligarchy. To privatize and sell off their public domain to foreign investors. To untax raw materials, to untax natural resource rents, to untax the housing, to create essentially a rollback of these countries to feudalism, so that instead of developing these countries, it underdevelops them.

The main tool that the United States uses through the IMF, which you should think of it as the IMF being a small room in the basement of the Pentagon, used essentially to promote U.S. foreign policy and make sure that you can financially bankrupt with sanctions or just withholding loans or currency rates on any country that’s not following the U.S. neoliberal centralized control program. The way that this is done is through the dollar standard you’ve just seen last week. The United States grabbed $7 trillion or billion —

Paul Jay

No billion.

Michael Hudson

Grabbed all of Afghanistan’s foreign exchange reserves here because it said we’ve appointed the Afghan version of Venezuela’s, [Juan] Guaidó. We get to appoint the leader of any country, and we’ve taken all the money away from Afghanistan on behalf of the foreign leader. Saudi Arabia attacked many Americans, and they’re Islamic, just like Afghanistan, so we’re going to just seize Afghan’s gold, foreign exchange, just like the bank of England seized Venezuela’s gold reserves and said, we’re giving this to Mr. Guaidó and the opposition to fight against the elected government there.

So basically, the Western economies are centred on the dollar standard so that the Eurozone and America’s other satellites are basically satellites of the dollar area in order to function internationally. To do their banking and investment and foreign trade, they all have to depend on the dollar, which essentially gives the United States the power to do what it’s been threatening to do with Russia and China, cut them both off from the bank clearing system so that essentially they can’t use the dynamics to clear banks.

The point that I’m making is the United States’ way of controlling other countries is not military because you’d need a draft for that. You’d need an army that actually would be occupying. The era of military occupation is all over. The mode of control is financial. The financial mode of control is essentially to make loans on terms that cannot be repaid so that when they’re not repaid the creditor countries, the U.S. can foreclose on the assets of countries like Paul Singer did on the assets of Argentina when it couldn’t pay its foreign debts.

China is in a different position because its currency is not a global currency when it makes foreign investment on its belt and Road initiative. I think when we’re talking about China’s foreign investment and foreign relations, the belt and road is really what should be the key. The central part of this is that China is developing ports and transportation systems to link its economy to the Atlantic if possible. It’s brought up by the Port in Athens, the local Port is now Chinese. It’s seeking to buy up ports in other countries. The security for these loans are not general government securities like a foreign debt. A Chase Manhattan loan to a foreign government will give the United States the right to grab a property of that government anywhere if it doesn’t pay the bonds. The security is just the entire government’s property.

China is acting not as a moneylender as a financial investor. It’s not financial imperialism. It is investing essentially as a stockholder. The security for its loans, as I understand it, are the assets that it is either creating or buying. So that if, for some reason, the Port of Greece wasn’t able to pay whatever the stipulated liability was, China couldn’t grab the Parthenon or grab whatever Greece had abroad. All it has is the backing of the security itself. So investing in the country in the form of direct investment as equity investment instead of generalized financial credit is a completely different system and is the antithesis of neoliberalism.

Paul Jay

Patrick, go ahead.

Patrick Bond

I’ve got to disagree with you in the most comradely way, Michael, because we really are getting down to the question, does Beijing’s role in multilateralism and world finance present an alternative, as you posit, or as I would argue, an amplification of the worst features? So let me just throw a couple of quotes at you. I think Barack Obama when he was interviewed by The Economist magazine in 2014. The Economist interviewer said the key issue is whether China ends up inside the multilateral financial system or challenging. That’s a really big issue of our times. I think Barack Obama, quote, “it is. And I think it’s important for the United States and Europe to continue to welcome China as a full partner in these international norms.”

So really, I’m going to argue quickly that China has been assimilated into the IMF. It’s not just the yuan becoming one of the reserve currencies. It’s not just that there’s one corrupt criminal IMF managing director after the other. I’m not exaggerating. [Alexis] Rodríguez-Rata, the Spanish leader, is in jail now. Dominique Strauss-Kahn was accused of raping a hotel cleaner in New York and had to resign in 2011. The successor was Christine Lagarde, who was prosecuted successfully for doing a deal with the Adidas chair to fund the French Conservative Party. She was brought to the IMF after the conviction, and nothing happened. The Chinese voted in favour of keeping her on. Or Kristalina Georgieva, the current IMF managing director, who was just implicated a few weeks ago in manipulating data on behalf of China when she was top World Bank official.

One after the other, Michael, we’ve had IMF managing directors of the lowest calibre. World Financial, we have a name here, Tsotsi, low-level criminals. Yet China continues to support the leadership and never puts a challenge up again and again when there are elections. Wouldn’t China, with Russia, with Brazil, with India, with South Africa, with other emerging countries, say it’s time to get rid of it of the Europeans only?

That was the phrase in South Africa for whites only, Europeans only. They seem to have taken our old signs. They put them on the door of the IMF, and China doesn’t object. In fact, China invests even more. China raised its investments into 2015 IMF recapitalization to record highs. It’s the number two investor. You put the other BRICS together, they’re nearly at that U.S. 15% level where they could veto. In terms of the content of what China is promoting in IMF, it’s exactly the same. We’ve never seen the Chinese delegates in the IMF come up and say this is wrong.

Again and again, I think what I said, with Xi Jinping’s ideologically oriented global neoliberal corporate rule. The IMF is one, the World Bank is another, the World Trade Organization is another. I could go into the UNFCCC, wherein in 2009 in the Copenhagen Accord, Wen Jiabao, the Chinese leader, agreed with Barack Obama to throw out any vestige of any potential liability or accountability in climate. I could go on and on because you just find the Chinese fitting in. Not as interim Imperial rivalries as Biden, and before that, Trump or Obama might have posited, but really as a sub-Imperial ally of the West in multilateral financial oppression. You can’t deny any of that, can you?

Michael Hudson

Well, I certainly can’t deny your examples because I’m just not familiar with them. I assume you’re on sound ground when you talk about corruption. I think corruption is again what we talked about in the first half. It spans socialism, capitalism, feudalism. It’s independence of the political system. So I’m not sure that there’s anything uniquely socialist or Chinese about it. You’ve quoted a number of quotes from the Chinese about, yes, we want open markets and neoliberalism. I wondered about these quotes, and I talked to the Chinese at the time about them, and they said, look, we’re really worried that America is trying to provoke a military attack on us. We are very defensive against the anti-Chinese position of the American government, especially the Trump administration.

What they’re trying to do is drive a wedge between the various parts of the U.S. state that is opposing it and their main allies that they found are Goldman Sachs and the Wall Street interest. So, of course, they’re going to say, we want free trade. We love your American neoliberal ideas, but these are words to sort of avoid the kind of attack that they’re worried about. Of course, Obama would love to co-opt China into the IMF and into the World Bank.

I think that would be a disaster because I think these are U.S.-centered organizations whose ideal development strategy would be essentially to neoliberalize China. I don’t see China ever having been willing to join something like the Trans-Pacific Partnership that said corporations can sue governments for any government rule. The investment dispute, the clause of that. That would have run against anything that China ever could have signed. I would say China is fighting against this. Whether there is, I have no reason to deny all the examples that you can say about corruption and trying to get a foreign government to support your project instead of the U.S. project where the U.S. is trying to bribe other people. That’s been the source of U.S. policy since 1945.

That’s how it’s co-opted Europeans, who are certainly the easiest people of all to corrupt, the politicians. So, I think that if you’re going to have foreign relations with an absolute, corrupt, rotten client oligarchy, the only way that you can have foreign relations is to join the crowd and outbid your opponents in bribery to get what you want. That’s probably a fact of every economy, and it’s not that it’s socialist or capitalist. I don’t know any way around that, if they’re promoting one set of policies and companies, as opposed to the U.S.-sponsored companies, I just don’t know what’s the solution.

Paul Jay

Patrick, just before you answer those points, let me just ask you something and then get to Michael’s point, which is, isn’t China doing more than just amplifying what the U.S. and the West does? When you take Latin America, China has provided, if I understand correctly, a way for some of the progressive governments in Latin America that are trying to escape from American financial blackmail. They’re giving them another way to have finance and escape some of that. Is that not bucking the American system to some extent?

Patrick Bond

I think again, Latin Americans would speak more eloquently than me, but the one country I’ve spent quite a bit of time in the Amazon on the Ecuadorian border with Peru, place called Yasuní. In Quito, it’s absolutely the opposite. It’s where the Chinese went behind the back of society to work with the then leader Rafael Pereira to drill the most biodiverse hotspot in the world for oil. We know what Chevron did there. Texaco, Chevron is implicated in $18 billion of damage and penalties. What the Chinese are doing is really in the same mould.

Paul Jay

But hasn’t China given financing to Venezuela, to Bolivia that’s given them an alternative to the pressure the Americans put on?

Patrick Bond

Well, I’d love to see what the strings attached are because every time we hear about these alternatives, especially in really wretched countries like Zimbabwe. The look East policy that Robert Mugabe described, he was adopted after in 2000, the land invasions that he sort of promoted as having lost a constitutional referendum and needed a mass Left populist project. He got the land invasions going, you recall. Whites were kicked off, some benefits to that, but the West cancelled him. So he did a look East.

I must tell you, Paul, by 2016, Mugabe was very old at the time. I think it was 2019, in his ’90s. He actually said, look, I made a mistake by looking East because we had $15 billion of diamonds, and we got some finance for that, but we only found $2 billion. The 13 billion disappeared. You can find his own speeches to say, this is where the Chinese took our diamonds. So was there an alternative to the kind of rapacious? In that case, it was a man called Sam [inaudible 00:29:47], a notorious cowboy in this region, and then jailed, but it was also a Chinese Army company called Anjin working with the Zimbabwean generals. They killed hundreds in the area called Morangi to get what was the world’s greatest diamond field.

So may I just present to you what I think the is the alternative? It comes from [inaudible 00:30:09], the first premiere, and in 1963, he visited Africa. He came up with eight principles very quickly, mutual benefit. Second, no conditions attached. Third, no interest or low-interest loans so as not to create a debt burden for the recipient country. Fourth, to help the recipient nation develop its economy. Fifth, not to create dependence on China. Now, these days with commodity experts more or less all going to China, that’s radical. 6th, to help the recipient country with projects that need less capital and quick returns. 7th, the aid and kindness must be of high quality at world market price to ensure technology can be learned and mastered by locals. Eight, the Chinese experts and technicians working for the aid recipient country are treated equally with local ones with no extra benefits. Now all of those eight wonderful conditions that really reflected the is a Tanzania, Zambia railway, the Tanzan railway. There are many projects of that era that I look at with enormous nostalgia because what we see today is absolutely, brutally super exploitative and extractive.

So I don’t think what China does in this part of the world follows [inaudible 00:31:19] principles. If there are any Chinese that are going to put that sort of solidarity back onto the agenda, you’ll have a lot of African supporting those very clear principles of solidarity, not super-exploitation.

Paul Jay

Michael.

Michael Hudson

Well, I can’t disagree with what Patrick said. I have had a contact with numerous African National leaders. I found them absolutely crooked. I’ve actually invested some of my own money. In all cases, I found that one cannot deal with them unless one matches their demands for corruption and crookedness. That’s a fact of life that I guess China has decided. Well, it would be nice to be able to have a Democratic government and governments that actually represent the people. Unfortunately, the leaders of many of the countries that we want to have relations with are thorough scoundrels and Kleptocrats. How can China deal with the Kleptocratic leadership of a country which are very many countries and still maintain the ideals that you cited?

I don’t know what the solution is, except well, they’ve got to meet the demands of the corrupt countries that the Americans and the British and the French have put in power. The Westerners have put in power a corrupt class. That’s part of the problem that prevents China from dealing with, or any country, or honest people anywhere from dealing with these countries in a non-corrupt way.

I wasn’t able to do it. I lost quite a bit of money. My friends lost money. Everybody I met on Wall Street, Left-wingers, positive people, tried to help African countries and Latin American countries, and they all said we just can’t cope with a degree of corruption, play their game or there’s no relationship.

Patrick Bond

Maybe I can just jump in because if you’ve chosen the wrong partners, Michael, I’m absolutely delighted you lost your money. That’s a good lesson. I hope many people are listening. Don’t work with corrupt dictators on this continent. Work with the masses. They’re uprising, there’s protests going on all the time. In this country, let’s just give a quick example, when Xi Jinping worked very closely with Jacob Zuma, in fact, the Chinese brought South Africa into the BRICS. It was at the expense of helping our mass base. We had a great leader. You may know the name, Archbishop Desmond Tutu. He passed away the day after Christmas a few weeks ago. Terrible loss because this was our greatest South African. Yet, when he wanted to have an 80th birthday and meet his old friend, the Dalai Lama, Xi Jinping’s government and its predecessors, again and again, refused to give the South Africans permission to issue a visa, even though the Dalai Lama was in India.

This was the power to intervene, the political choices. Instead of working with Archbishop Tutu to help clean up the mess of the Zuma regime, that Beijing was absolutely supportive of, including those tens of billions of grants, of billions of dollars of loans for corrupt locomotives that China South Rail was buying, and that we’re basically pass off’s to Zuma as allies, the Guptas. It’s that choice where you join with the corrupt Kleptocrats, as you put them, put in place, often by neocolonialism, or you break, and it’s that choice that allows you to either really pose an alternative, say, the way Cuba has, or the way alternative movements around the world have to unite together, for example, to get AIDS medicines off of the patent 20 years ago, which raised our life expectancy from 52 to 65 before COVID. That’s the choice to work with the base or to amplify the problems by empowering the dictatorial kleptocratic, corrupt crew. Again, I’m sorry you lost your money. I shouldn’t have joked about that, but I do think we all get lessons from that.

Michael Hudson

Couldn’t tell who was a crook and who wasn’t a crook at that time, 40 years ago. I know a lot more now about politics. I do think that corruption is inherent in politicians everywhere. No continent has a monopoly on it. I can’t deny, I’m sure you followed all of these cases. All I can say is that I’m talking about the system of exploitation that needs to have an alternative to the IMF and the World Bank system that’s locked in. China, being driven to de-dollarize its economy, has a leadership pushed upon it to create an alternative to a dollarized world economy. Everything that I’m writing in China and my lectures are how China can create a different international economy.

I’m sure that the cases, you’re right, are part of the diplomatic record and the historical record. All I can say is you posed the problem correctly. I think a precondition for the solution of the problem. The way that you and I would like to see it with honest governments and helping countries develop is it has to be done outside the dollar area, and I look at China and Russia and now Iran. The Shanghai Co-operation Organization is the only group that can have the critical mass that is even in a position to be able to create an alternative to dollarize neoliberal imperialism.

Patrick Bond

May I just butt in and ask, why doesn’t China stop its accumulation of T-bills [Treasury Bill]? It’s still the biggest single investor in the U.S. Secondly, there’s a bigger process really, which is, flows of surplus. China is in the world economy. Some would like to call it imperialist, but I think that’s exaggerated because simply looking at the flows of profits, dividend ratios, the profits coming into Chinese companies, Huawei, Tencent, Alibaba, and all of the other big ones, on the one hand, those profits coming in. Versus profits going to Western companies or other companies outside China, and it’s really still at about 20%, meaning China is losing a vast amount of its surplus. As Michael Roberts, the economist, says, it’s really not an imperialist, it’s a victim of imperialism. So I completely agree. There’s a whole layer of sub-Imperialists that are between about 20% and 60%, South Africa, Brazil, Russia, India amongst them.

It seems to me, breaking from that, putting on total exchange controls, stopping that kind of ideology of the world economic form of liberalizing corporate power, and then maybe selling those T-bills, starting a run on the U.S. dollar. I would be excited, and I’d be very convinced by you, but instead, I see China locked into the system, legitimating it, empowering it, giving it finance. The last case is since you hate the IMF, I’m sure I aspire to hate the IMF as much as you, Michael. Isn’t it extraordinary that when in 2015 the IMF needed more money, it was China that popped in the most and did so by lowering the voting power, the voice of poor countries.

So, for example, Nigeria lost 41%, and Venezuela lost 41%. Even South Africa lost 21%, but China won an extra 37% vote. That, to me, says they’re part of the system deputy sheriffs for that East Asian rim, in it like Japan. In a sense doing even worse because they’re taking the same model. Amplifying it elsewhere. Do I not make sense.

Patrick Bond

You put your finger on the key prompt dilemma that the dollar standard and dollarization has posed on other countries. You’re quite right that China became the major purchasers of Treasury securities. Here’s why it did that and the dilemma that it’s quite aware of. When Americans and other countries buy Chinese exports, they pay in dollars. China receives the dollars. The local producers will probably turn it over to the Bank of China to get local currency, and that means the Central Bank of China ends up with these dollars.

Now, what is it going to do if it does not buy treasury bills? If it does not recycle these dollars into the U.S. economy by buying some kind of dollarized asset, and the United States won’t let it by companies, it won’t let it by assets. It’ll only let it buy treasury bills which are loans to the U.S. Treasury. If it does not recycle these, then China’s exchange rate from the dollar flow into China will push up the Chinese currency, and by pushing up the Chinese currency will make its exports much more expensive.

So in order to stabilize its exchange rate, China and every other payment surplus country in the world has to recycle its dollar inflows into the U.S. Treasury, which essentially uses the money to finance the military spending that builds up the 780 military bases surrounding the rest of the world to try to prevent them from creating an alternative to the dollar standard.

So China, like Russia, has been reducing its dollar holdings as much as possible, just keeping enough to prevent the currency from being destabilized by the dollar inflows. China, Russia are buying gold instead of U.S. dollars as much as possible. China is trying to escape from this, buying Treasury securities. Why would any government want to buy Treasury securities yielding 0.1% when the dollars coming into China are trying to make loans or buying countries making 15% profit or interest a year? Nobody would want that situation to continue. China doesn’t want it to continue.

As long as it is part of an international economy that is dollarized, it is forced to take a loss, a sacrifice, year after year, subsidizing the U.S. economy. The only way that it can avoid that is to isolate itself from the U.S. dollar. No country until this time since 1945 has ever had the critical mass to be able to do it. That is the objective, the stated objective of Russia, China and their allies. Of course, they don’t want to buy treasury bills. That doesn’t mean that, yes, they found a wonderful investment making 0.1% a year and subsidizing the United States. That is not what China or any other country wants.

Paul Jay

Okay, Patrick, we’re getting near the end here, but please respond to Michael.

Michael Hudson

I will because I hate the Tina accusing you of Margaret. That’s right. There is no alternative rhetoric here because there is an alternative. Samir Amin visited China again and again and described to them de-linking strategies. The globalization is underway. There’s all manner of ways to avoid being sucked in. I would posit that the most humane and eco-socialist way of thinking about this is to say that if you’re in Beijing and have this vast surplus, you have this huge dollar reserve you owe, as do I personally. Sitting in Johannesburg in the global north, a climate debt. We should be cancelling debts to very poor countries. Mozambique next door. The worst-hit of Africa on the planet.

China is the major absolute contributor. It’s not historically the most. And of course, a great deal of Chinese emissions are, in a sense, outsourced because they go into the consumer gets you, and I buy. But wouldn’t that be the way forward instead of Tina? We have a word in Zulu here. Michael Themba, T-H-E-M-B-A, it means hope there must be an alternative and demanding from China, the do reparations if they really cared about international obligations for wrecking so much of this continent and South Asia and East Asia. With so many climate catastrophes, it’s time for China to fess up and hopefully lead the world in saying a climate debt is overdue to countries in Africa. I certainly owe it, and I hope somebody in China has the ethics to say that’s what we should do with our surplus dollars instead of recycling it into the Pentagon.

Paul Jay

Michael, you got the last word here, and as I said in the first segment, this is the beginning of a conversation. Certainly not the end, but it’s an end of a segment. So you got the last word.

Michael Hudson

Well, the people who I deal with in China are doing just exactly what Patrick is recommending. Of course, I would agree with Samir Amin. I mean, we worked together in Greece. We always met at the Marxist conferences in Beijing, and both of us are very close to the group in Hong Kong, the world University that I work with there. So you’re absolutely right. Samir Amin had the right idea, and we’re doing everything we can to press for that.

Paul Jay

All right, great. So thank you both very much. I’m sure there’s going to be lots of questions that come in in the comments on the website, on YouTube. So we’ll gather again, and we’ll further develop the conversation. But for today, Michael, Patrick, thank you very much and thank you, everybody, for joining theAnalysis.news. Don’t forget to donate, subscribe and most importantly, get on the website, get on the email list, and we’ll see you again soon.

END